Are you a weekend warrior or daily commuter? Either way, we’ve got you covered!

Riding your motorcycle is one of our great freedoms, and there’s absolutely nothing like feeling the wind on your face as you explore the world on two wheels. With that freedom, however, comes great responsibility for you, your passengers, and other drivers.

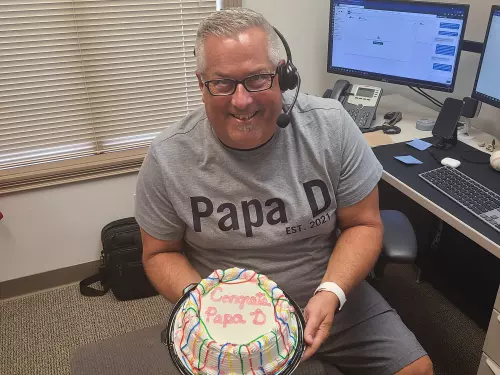

It shouldn’t need to be said, but every motorcycle owner should ride responsibly. And of course, beside learning to safely drive a motorcycle, it’s extremely important to have coverage in place in case the unexpected happens. Dean purchased his first motorcycle at age 17, and Ken purchased his at 19. With their long history of owning and riding motorcycles, they understand why you need the right coverage and can help find you the perfect option.

Our Advisors Don’t Work on Commission

Local Agency | Multiple Carriers | Insurance Simplified

Specific coverage for your specific needs:

- Liability coverage: Income in Hamilton County tends to be higher than the rest of the state. Consider where you live and make certain your liability limits are high enough to cover serious injuries and loss of others’ earnings due to injury from an accident.

- Medical Payments: These payments cover minor injuries and co-pays for you and your passengers, regardless of fault.

- Uninsured and Underinsured Motorist Coverage: This pays for injuries to you and your passengers caused by a driver who has too little or no insurance. We’re not all on the same road when it comes to coverage, so protect yourself from others.

- Property Damage Coverage: This covers your motorcycle and protects your bike if it’s damaged. You can choose a deductible for this coverage based on the amount of damage you’re willing to pay for out-of-pocket in the event of an accident.

- Accessory Coverage: Most policies automatically include up to $3,000 worth of aftermarket parts or custom accessories for no additional cost. You can purchase additional coverage for a max of $30,000 in extras.

- Transport Trailer Coverage

- Roadside Assistance Coverage

- Trip Interruption Coverage

- Total Loss Coverage

- Rental Vehicle Coverage

- On-Road Coverage for off-road vehicles

Contact us today to set up a Motorcycle Insurance Policy